77th SKOCH Summit | 20th November – 18th December 2021

CURTAIN RAISER: LIVING WITH CRYPTO

Cryptocurrencies are here to stay in different forms whether as floating currencies or Stablecoins- which are pegged to actual currencies or Digital coins issued by Central Banks. The rapid adoption of cryptocurrencies has also led to them being recognised as legal tender by countries like El Salvador.

There are questions on how cryptocurrencies can function like fiat currencies because of the wildly fluctuating nature of their value. However, The technological backbone on which cryptocurrencies function can be the foundation of transforming large-scale payments. An example of this can be when Hong Kong, China, Thailand and the UAE, together with the Bank for International Settlements’ Innovation Hub, carried out cross-border transactions with their central bank digital currencies, on an experimental basis. The transaction took seconds, instead of days, as with the conventional method of transferring payments via Swift. This shows that with the efficient implementation of Blockchain the nature and scale of large international transactions can be transformed.

The distributed ledger which underlies the blockchain technology is useful for supporting smart contracts which means that predetermined actions can be executed when payments are concluded on the blockchain. While the potential of this technology is huge, There are also underlying issues such as huge power consumption when compared to traditional forms of payments.

The policymakers have to come to terms with this new form of currency and dedicated awareness campaigns must be run to inform investors about the legitimate and illegitimate ways in which cryptocurrencies can be used. If the adoption of these currencies goes on unchecked it can undermine the stability of National Currencies and make it difficult for the Central Banks to implement Monetary policy effectively. The upcoming economic models will integrate Cryptocurrencies and Blockchain from the outset and it will have a definite impact on National Economies and their GDP.

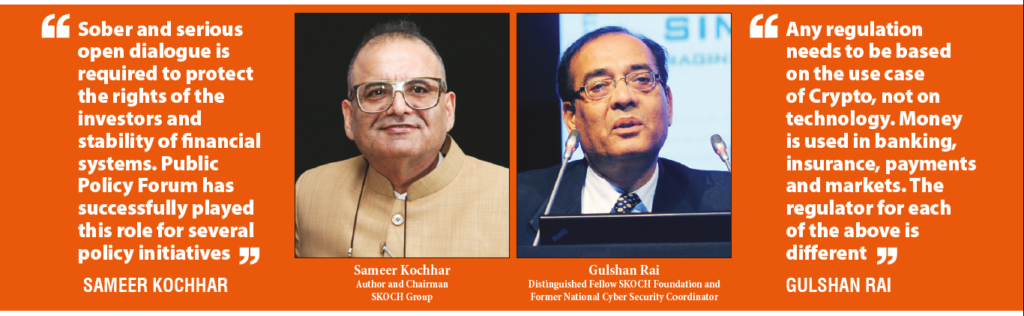

1000-1130 – CURTAIN RAISER & POWER PANEL ON REGULATION

Author and Chairman

SKOCH Group

Distinguished Fellow SKOCH

Foundation and Former National Cyber

Security Coordinator

Member of Parliament, Rajya Sabha

Member of Parliament, Lok Sabha

Independent Scholar & Distinguished

Fellow, SKOCH Development

Foundation

Chief Corporate & Public Affairs Officer Zupee & Chair CAII Committee on

Creator Experience, Economy & Gaming

Consulting Editor, The Economic Times

Distinguished Fellow, SKOCH

Development Foundation &

Former ED, RBI

1130-1230 – POWER PANEL ON TECHNOLOGY

Managing Director & Editor

SKOCH Group

Distinguished Fellow, SKOCH Foundation Development Economist &

Former Secy, GoI

Co-Founder, iSPIRT Foundation

Partner, Kalaari Capital & Crypto Economist

Professor, Information Systems &

Dean Programmes, IIM Bangalore

Digital Payments Strategist

1230-1330 – POWER PANEL ON INVESTOR PROTECTION

National Co-convenor, Swadeshi Jagran

Manch

Contributing Editor, India Ahead

Consulting Editor, Business Standard & Senior Adviser, Jana Small Finance Bank

Chairman of Fintech Convergence Council (FCC)

Chairman, HDB Financial Services

Ltd & Distinguished Fellow, SKOCH

Development Foundation

Senior Fellow, SKOCH Development

Foundation & Former Banker

BRINGING GOVERNMENTS AND PEOPLE CLOSER

The government’s commitment to “minimum government, maximum governance” has guided its policy, legislation and decision making at various levels. Advances in technological advancements – whether it is telecom, space, energy or information technology – have no doubt accelerated changes in governance, but the challenge before us is how to leverage these in the best possible and most practical manner so that even the last person at the end of the line, living in far and remote corners of the country, gets all that he needs in the form of service delivery with ease. It is in this context that this book is of immense relevance. It outlines the agenda as to what more needs to be done in the immediate future.

Dr. Ramachandran has very succinctly and in a very simple and straightforward manner brought out myriads of common problems people face, in both urban and rural areas. He has also described what measures need to be taken to bring out governance changes for effective delivery of services at the grass-root level.

M Ramachandran IAS, had a distinguished career in government from1972 to 2010, finally holding the challenging positions of Chief Secretary, Uttarakhand and then Secretary to the government of India in the Ministry of Urban Development. Although his various assignments he has been sensitive to the difficulties and problems which the common person faces and has made significant contributions to bring about changes in the system of governance. He is Distinguished Fellow, SKOCH Development Foundation.

1830-2000 – BRINGING GOVERNMENTS AND PEOPLE CLOSER

Managing Director & Editor

SKOCH Group

Special Secretary, Department of

Administrative Reforms and Public Grievances (DARPG), Govt of India

Distinguished Fellow, SKOCH

Development Foundation &

Former ED, RBI

Director General, Indian Institute of Public Administration

Former Member of Parliament

Rajya Sabha

Distinguished Fellow, SKOCH Development Foundation and Former Secretary, Government of India

ED, National E-Governance Services Limited & Former Principal Accountant General, Karnataka

SECURITY & DATA PROTECTION

India is transforming into a digital society owing to increased internet penetration which increased sharply from 2015 onwards. With over 750 million active internet users as of 2020, India is one of the largest digital markets in the world attracting global players. The rise in digital services being provided online by both the public and the private sectors has led to the generation of huge amounts of data. However, due to the unprecedented growth witnessed in internet accessibility entirely novel business models have sprung up which collect and analyse personal data for commercial purposes. The use of personal data for commercial purposes without any clear regulatory and legal frameworks poses grave risks for individual autonomy and privacy.

There is a need to construct an institutional and legal framework in such a way that it ensures utmost privacy for individuals while encouraging businesses to innovate and expand. There exists a need for a more comprehensive law to address data privacy concerns. The Personal Data Protection Bill seeks to include many aspects of the European Union GDPR laws. There are several challenges in implementing an effective data protection law such as how to govern the use of big data by large technology corporations and how to strike a balance between National security and citizen privacy concerns

Therefore policy formulation has to take into account all the recent developments in the area of commercial use of personal data so that legislation does not prove to be inadequate to handle the complex challenges that exist in this field. The policy has to strike a fine balance between necessary compliance and over-regulation. Because the bill will regulate the use of data in almost all economic activities there can be significant compliance costs specifically for businesses that are small in size. There has to be consultative dialogue with all the concerned stakeholders so that upcoming legislation can fulfil the tasks of protecting personal data and encouraging innovation

0920-1030 – SETTING THE STAGE

Author and Chairman

SKOCH Group

Distinguished Fellow SKOCH

Foundation and Former National Cyber

Security Coordinator

Head- Pre Sales, Tata Communications

Managing Director & Editor

SKOCH Group

Distinguished Public Policy Professional & Chair, CAII Committee on Creator Experience, Economy and Gaming

1030-1130 – DIGITAL TRANSFORMATION DIMENSION

Global Head – Cyber Security Consulting

& India Head – Digital Consulting,

KPMG

Commissioner, E-Governance

Government of Telangana

Joint Managing Director,

Inspira Enterprise

Special Secretary, Department of IT & Electronics, Uttar Pradesh

Secretary General, Federation of Indian MSMEs (FISME)

Distinguished Public Policy Professional & Chair, CAII Committee on Creator Experience, Economy and Gaming

1130-1230 – DATA PROTECTION AND BUSINESS STRIKING A BALANCE

Former Regional Managing Partner – North, PWC

Principal Associate, Ikigai Law

Co-Founder, iSPIRT Foundation

Partner and Leader, Cyber Security, PwC India

India Data Privacy Partner, EY

Partner, Kalaari Capital &

Crypto Economist

1230-1330 | THE FINANCE AND PAYMENTS DIMENSION

Partner & National Leader – Client and Markets (Trust and Transformation), Grant Thornton

Founder & CEO, Policy 4.0

Chief Information Security Officer and Data Protection Officer, Future Generali India Life Insurance

Global Head – Security Operations, Compliance & Investigation, Fareportal India Pvt Ltd

Corporate Director –

Security & IT Processes,

The Indian Hotels Company Ltd

PANDEMONIUM: THE GREAT INDIAN BANKING TRAGEDY

“The Reserve Bank of India would like to assure the general public that Indian banking system is safe and stable.” – RBI statement, 1 October 2019

Why did India’s central bank have to issue an unprecedented statement to that effect?

In Pandemonium: The Great Indian Banking Tragedy, Tamal Bandyopadhyay takes you in search for the answer. It is a compelling story on the rot in India’s banking system – how promoters easily swapped equity with debt as bank managements looked the other way to protect their balance sheets, until the RBI began waging a war against ballooning bad loans.

What really ails public sector banks, the backbone of India’s financial system? Is it the government ownership itself, or how this owner actually behaves? And just when many were rooting for privatisation as a way out, powerful bankers such as Chanda Kochhar and Rana Kapoor exposed the soft underbelly of seemingly more efficient and profitable private banks of India.

A timely and insider look at the dramatic forces reshaping banking in Asia’s third-largest economy, this book is a bird’s-eye view of Indian banking and also a fly-on-the-wall documentary. A must-read to understand contemporary India’s challenges and economic potential.

Tamal Bandyopadhyay has been a keen student of Indian banking for the past 25 years. A lifelong reporter and journalist, he is an award-winning national business columnist and a bestselling author. He is widely recognised for ‘Banker’s Trust’ a weekly column whose unerring ability to anticipate and dissect major policy decisions in India’s banking and finance has earned him a large print and digital audience around the world. The column won him the Ramnath Goenka Award for Excellence in Journalism (commentary and interpretative writing) for 2017.

Banker’s Trust now appears in Business Standard, where he is a Consulting Editor. Previously, he has had stints with three other national business dailies in India, and was a founding member of Mint newspaper and Livemint.com.

Author of five other books, Tamal has been named by Linkedin as one of the “most influential voices in India’.

1830-2000 – PANDEMONIUM: THE GREAT INDIAN BANKING TRAGEDY

Co-Founder, Salt

Consulting Editor, Business Standard & Senior Adviser, Jana Small Finance Bank

Former Executive Director, RBI

Former Deputy Governor, RBI

Chairman, HDB Financial Services Ltd & Distinguished Fellow, SKOCH Development Foundation

RISING TO THE CHINA CHALLENGE

WINNING THROUGH STRATEGIC PATIENCE AND ECONOMIC GROWTH

Confit has resurfaced on the China-India border. The framework that had prevailed from 1988—to proceed with deep engagement while the border issues lay unresolved–has come to an end.

The events of Doklam and Ladakh are not the end of this story. India now faces the prospect of a hostile relationship with China. This is not just a problem of sending troops to Ladakh; this is a problem that will play out on a strategic scale. It is difficult for India to navigate these waters, as China is substantially ahead of India in many aspects.

Thinking about these questions and developing an intellectual framework for Indian strategy is very important in India today, and will have an impact on a broad swathe of Indian policy planning.

In Rising to the China Challenge Gautam Bambawale, Vijay Kelkar, Raghunath Mashelkar, Ganesh Natarajan, Ajit Ranade and Ajay Shah, examine this problem from India’s point of view, and develop the elements of the Indian strategic response. Their in-depth study of China and a compare-and-contrast with India establish the roadmap for the economic, diplomatic and military aspeets of the bilateral relationship. This book represents a holistic picture that integrates these three diverse perspectives.

Rising to the China Challenge is a call to action that policy planners will find invaluable while engaging in deep consultations and developing a pragmatic way forward.

1900-2030 – RISING TO THE CHINA CHALLENGE

Co-Founder & Director,

Trayas

Executive Chairman & Founder,

5F World

Managing Director & Editor

SKOCH Group

Executive President & Chief Economist,

Aditya Birla Group

China Correspondent, The Times of India & Author of Running with the Dragon

Senior Fellow

ORF

Research Fellow

ORF

Senior Adviser, NCAER &

Former Member, 14th Finance Commission

Post-Doctoral Research Fellow, Department of International Relations and Governance Studies, Shiv Nadar University

10 FLASH POINTS 20 YEARS

An insightful examination of the challenges that have characterized Indian foreign policy in recent years by one of our more thoughtful political figures.

For India to grow, prosper and achieve its true potential, it requires peace on its periphery. But this amity has eluded it since 1947. The challenge from Pakistan and China, and now from the China– Pakistan nexus, has not allowed India to break out of its neighbourhood’s quagmire.

In the past two decades, the challenges to India’s national security have only exacerbated both in complexity and intensity. The seizure of Afghanistan by the Taliban and the complete withdrawal of all the military forces of the United States and its allies have opened up a security void creating a strategic vacuum in the region. It would have profound implications not only for Pax Americana, but for nations in the arc of turbulence.

10 Flashpoints; 20 Years looks back at the security situations that have impacted India in the past two decades and dissects our responses—both successes and failures—to them. Manish Tewari examines the tools and processes of Indian statecraft defence, diplomacy and intelligence, and weaves a veritable tapestry around the institutions and individuals that form part of the country’s national security establishment. He also offers suggestions on ways in which the national security doctrine can be reformed to meet the demands of the twenty-first century’s regional and global security environment.

Manish Tewari is a lawyer and a member of parliament representing Sri Anandpur Sahib in Punjab in the 17th Lok Sabha. He served as the union minister of state (independent charge) in the Ministry of Information and Broadcasting. He was the spokesperson of the Cabinet and the United Progressive Alliance (UPA) government. He is currently the senior national spokesperson of the Indian National Congress (INC).

He served as distinguished senior fellow at the South Asia Centre of the Atlantic Council and as honorary advisor to the Observer Research Foundation (ORF). He has served on the standing committees of law and justice, defence and foreign affairs, and the joint parliamentary committee, which examined the issues pertaining to the telecom sector from 1994–2009, as well as the parliamentary consultative committee of defence.

He currently serves on the standing committee of finance and joint committee of parliament examining the Data Protection Bill as well as the parliamentary consultative committee of defence.

1300-1400 – 10 FLASH POINTS 20 YEARS

Author & Columnist

Member of Parliament,

Lok Sabha

GAMING THE NEW FRONTIER

India`s online gaming sector has boomed at a phenomenal rate in the last few years, The industry in India is projected to reach the size of Rs. 290 Billion by 2025 backed by a rapidly growing consumer base of around 420 Million users. The increased penetration of mobile internet has contributed to the majority of new users coming from Tier-2 and 3 towns. While India is set to become one of the largest gaming markets globally, there is an emerging need for robust and efficient regulatory and legal mechanisms to aid the industry in realising its true potential.

The gaming industry has transcended the digital divide and has both positive and negative real-life implications. The growth of eSports has led to investment and job creation on one hand and visible concerns about misleading advertising and gambling addiction on the other hand. there have to be clear guidelines to prevent misleading advertising to ensure user safety. Only concerted efforts from both Industry and Government can lay the ground for a sustainable regulatory framework

There are several ambiguities regarding the legal and taxation implications in the gaming industry, this is hampering the creation of a clear policy roadmap through which this industry can be governed. One of the most pertinent issues is the categorisation of a game as a “Game of Chance’ or a “Game of Skill”, This classification itself has varying implications for taxation purposes. Therefore the development of a rational and uniform taxation regime for the gaming industry on par with other technological platforms can go a long way to contribute to the target of a Trillion Dollar Digital Economy for India

Policymaking has to be ahead of the curve when it comes to online gaming to be able to make the maximum impact through dedicated interventions. The exponential growth which this sector has witnessed in the last few years is bound to continue in the near future as well contributing to our National Economy and GDP making it a priority for Industry and Government both.

1050-1300 – GAMING THE NEW FRONTIER

Chairman, SKOCH Group

Distinguished Fellow

SKOCH & Former ED, RBI

Commissioner & Secretary

Public Health Engineering Department

Government of Assam

Principal Secretary – ITE&C

Government of Telangana

Secretary, Electronics & IT

Government of Odisha

Secretary, IT Department

& CEO, JaKeGA

Distinguished Public Policy Professional & Chair, CAII Committee

Founder, GamerJi

Director

Esports Federation of India

Director (Research)

CUTS International

Partner

Ikigai Law

Indian Institute of Public

Administration

Board Member

Witzeal Technologies Private Ltd

Digital Transformation & Inclusive Growth

Digital Transformation in the context of Governance is supposed to bring in a socio-economic change that fosters a higher degree of digital, financial and social inclusion. Since 2014, the Digital India Programme has led this change. This panel reviews the progress made thus far and the road uncovered.

The glass half full perspective sees significant improvements in entitlements, banking and payments and the glass half empty perspective points to poor credit, markets access, development opportunities and gendered exclusion. We have put together some of the brightest experts in this area to discuss and return recommendations on the next steps:

- Access to Entitlements

- Access to Banking and Payments

- Access to Credit

- Access to Markets

- Access to Development Opportunities

- Access to the above for Women

1800-2000 – DIGITAL TRANSFORMATION & INCLUSIVE GROWTH

Chairman, SKOCH Group

Additional Chief Secretary

Government of Assam

Distinguished Fellow

SKOCH Development Foundation & Former ED, RBI

President & CEO NeGD

Ministry of Electronics & IT

Government of India

CEO, Real Time Goverance Society

Andhra Pradesh

Global Head – Cyber Security Consulting & India Head – Digital Consulting

KPMG

Distinguished Public Policy Professional & Chair, CAII Committee on Creator Experience, Economy and Gaming

Managing Director

Shree Mahila Sewa Sahakari Bank

Domain Expert & Former Regional

Managing Partner – North, PwC

Public Policy Leader for Public Sector

(India/SAARC), AWS

Co-Founder

iSPIRT Foundation

Co-Founder, Salt

Leader, Government & Public Sector Markets and Healthcare Sector

Ernst & Young

INSTITUTIONAL CHANGE AND POWER ASYMMETRY IN THE CONTEXT OF RURAL INDIA

This book explains how to bring about institutional change and foster new institutional structures (institution building) by resolving power inequities in a rural ecosystem in India, and advocates the identification of an appropriate institutional champion to make this happen.

The book develops a power-asymmetry-based framework and argues that a champion with the right attributes and the ‘ability’ to ‘convene’ people over a social issue can only succeed if he/she can resolve or reduce the deep-rooted societal power asymmetries within that community. It also presents four case studies that indicate how such social change is typically spread over a long period of time.

Amar Patnaik is a former civil servant belonging to the Indian Audit and Accounts Service under the Comptroller and Auditor General of India from where he prematurely retired to join the academic world. He has held positions of principal Accountant General of Sikkim, Odisha, Kerala and West Bengal during his service career. He was also the Director of the Agricultural Marketing and Co-operatives Department of Odisha, India, where he designed sustainable livelihood models for farmers through efficient and effective marketing of their produce.

1830-2000 – INSTITUTIONAL CHANGE AND POWER ASYMMETRY IN THE CONTEXT OF RURAL INDIA

Managing Director & Editor, SKOCH Group

Member of Parliament

Rajya Sabha

Executive Director, Self Employed

Women’s Association

Member of Parliament,

Rajya Sabha

CEO & Director, Microfinance

Institutions Network (MFIN)

Distinguished Fellow, SKOCH

Development Foundation and Former Secretary, Government of India

SKOCH Public Service Award & SKOCH Literature Award

- 10:30-11:00 – Meet and Greet at Silver Oak Patio

- 11:00-13:00 – Awards at Silver Oak

- 13:00 Onwards – Specially Curated Lunch

Venue

Silver Oak

India Habitat Centre

Lodhi Road, New Delhi

1000 -1330 – Curtain Raiser: Living with Crypto – 20th Nov 2021

1830-2000 – Bringing Governments and People Closer – 3rd Dec 2021

0920-1330 – Security & Data Protection – 4th Dec 2021

1830-2000 – Pandemonium: The Great Indian Banking Tragedy – 8th Dec 2021

1900-2030 – Rising to the China Challenge – 9th Dec 2021

1300-1400 – 10 Flash Points 20 Years – 10th Dec 2021

1050-1300 – Gaming the New Frontier – 11th Dec 2021

1800-2000 – Digital Transformation & Inclusive Growth – 15th December 2021

1830-2000 – Institutional Change and Power Asymmetry in the Context of Rural India – 16th Dec 2021

Programee

Dr Ashwani Mahajan, National Co-Convener, Swadeshi Jagaran Manch

Dr Ashwani Mahajan, National Co-Convener, Swadeshi Jagaran Manch